Understanding the Bitcoin Blockchain: A Simple Overview

Understanding the Bitcoin Blockchain in 2025- Blockchain technology is one of the most revolutionary innovations of our time, and Bitcoin is the first-ever application of this technology. The Bitcoin blockchain has paved the way for a decentralized financial system, where transactions are verified by a global network rather than centralized institutions like banks.

What is Bitcoin Blockchain?

To understand the Bitcoin blockchain, let’s break it down into simple parts.

- Bitcoin is a cryptocurrency, a form of digital money that operates without the need for a central authority like a bank or government.

- Blockchain is the technology behind Bitcoin, acting as a public ledger that records all transactions across a network of computers. Every time someone sends or receives Bitcoin, that transaction gets recorded in a “block.”

- Bitcoin Blockchain is essentially a chain of blocks, each containing a list of transactions. These blocks are linked together in a linear sequence, creating an immutable record of every transaction that has ever taken place in the Bitcoin network.

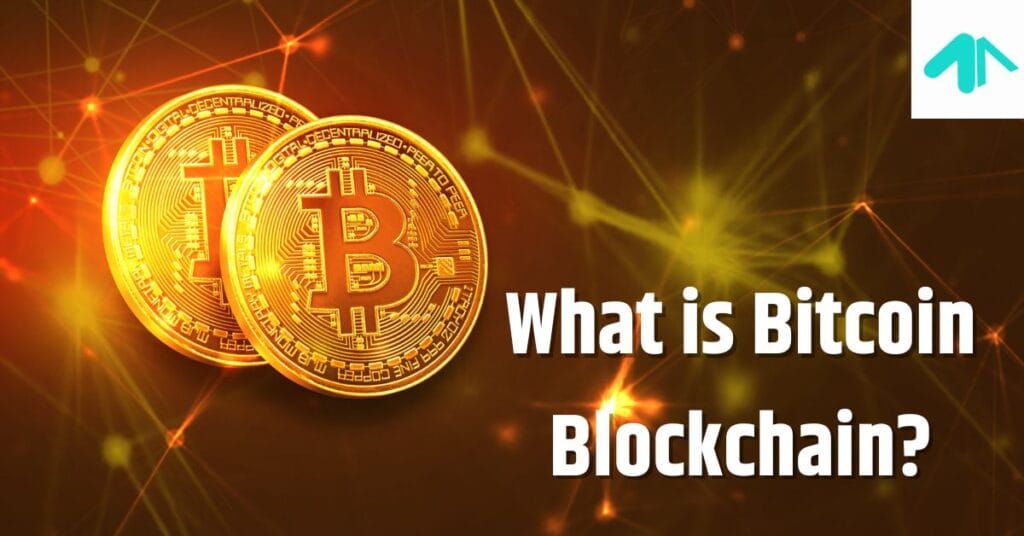

A Day in the Life of the Bitcoin Blockchain

To understand how the Bitcoin blockchain works, it’s helpful to visualize a typical day in the life of the network.

1. Starting the Day: New Transactions

At the start of the day, Bitcoin users initiate transactions. Let’s say Alice wants to send some Bitcoin to Bob. Alice creates a transaction by signing it with her private key (a unique cryptographic signature) and broadcasts it to the Bitcoin network.

This transaction doesn’t instantly appear on the blockchain, though. Instead, it goes into a pool of unconfirmed transactions, often referred to as the mempool. This pool holds all the pending transactions that miners need to validate.

2. Mining and Validation

Now, the real work begins. The Bitcoin network uses a process called mining to validate transactions and add them to the blockchain.

In mining, a network of computers (or “miners”) works on solving a complex mathematical puzzle. The first miner to solve the puzzle gets to add the new block of transactions to the blockchain. This process is called Proof of Work (PoW). It ensures that no one can manipulate the transaction history and guarantees the integrity of the blockchain.

Mining is very competitive. To increase their chances of solving the puzzle, miners use special hardware (called ASICs – Application-Specific Integrated Circuits) designed specifically for solving cryptographic puzzles at high speeds. The process consumes a lot of energy, but it’s the backbone of Bitcoin’s security.

3. Adding the Block

Once a miner solves the puzzle, they broadcast the new block to the rest of the network. Other miners verify the solution to ensure it’s correct, and if everything checks out, the new block is added to the chain.

This process is crucial for keeping Bitcoin decentralized. Since there is no central authority, the blockchain network depends on miners to ensure that all transactions are legitimate. Once the block is added, it becomes part of the permanent record, and Alice’s transaction to Bob is officially recorded.

4. The Blockchain Continues to Grow

Once a block is added, the process repeats. More transactions are initiated, added to the mempool, validated by miners, and recorded on the blockchain. As each new block is added, it gets linked to the previous one, forming an unbreakable chain.

This is why the Bitcoin blockchain is often referred to as immutable—it’s nearly impossible to alter a transaction once it’s been added to the blockchain. To alter a transaction, an attacker would need to change every subsequent block, which requires an immense amount of computing power and energy.

5. Reaching Consensus

Bitcoin’s blockchain relies on a consensus mechanism to ensure that all participants in the network agree on the current state of the ledger. In the case of Bitcoin, that mechanism is Proof of Work (PoW). PoW requires miners to solve the cryptographic puzzle and demonstrates their commitment to the network. Once the puzzle is solved, the majority of participants agree that the new block is valid, and the transaction is officially confirmed.

This decentralized consensus ensures that no single entity can control the Bitcoin network, making it resistant to censorship and fraud.

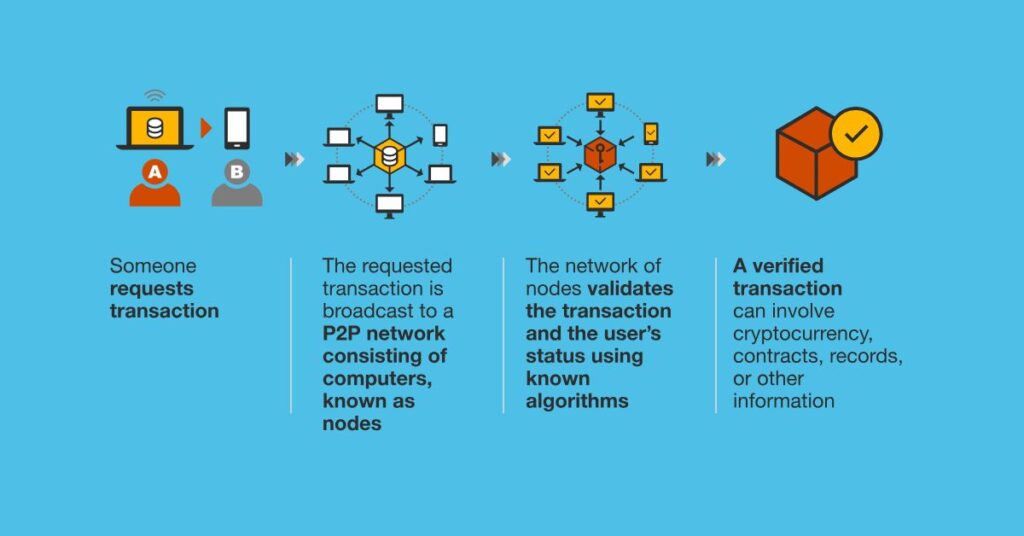

How Bitcoin Blockchain Works

1. Transaction Initiation

A Bitcoin transaction is initiated when a sender transfers Bitcoin to a receiver. The transaction is broadcasted to the Bitcoin network, where nodes verify its validity.

2. Transaction Verification

Bitcoin nodes check if the sender has enough balance and if the transaction follows Bitcoin’s rules. Valid transactions are grouped into a block.

3. Mining and Proof of Work

Miners compete to solve a complex mathematical puzzle using computational power. This process, called Proof of Work (PoW), involves finding a valid nonce that, when combined with the block data, produces a hash that meets the difficulty target.

4. Block Confirmation and Addition

Once a miner successfully solves the puzzle, the block is added to the blockchain, and all nodes update their copies of the ledger. The miner receives a block reward (newly minted Bitcoins) along with transaction fees.

5. Security and Immutability

Each new block contains the hash of the previous block, making it impossible to alter past transactions without re-mining all subsequent blocks. This ensures immutability and prevents fraud.

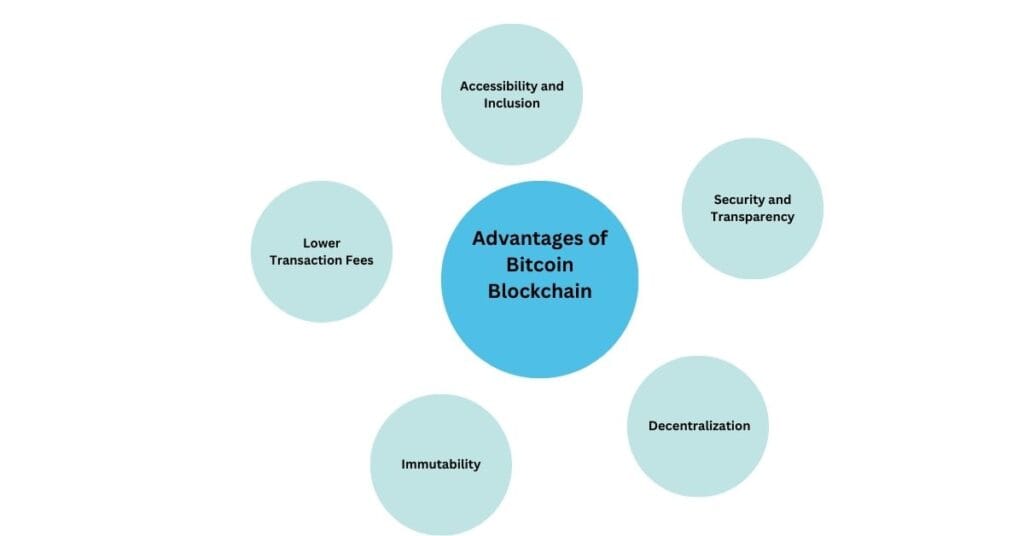

Advantages of Bitcoin Blockchain

Now that we’ve covered how the Bitcoin blockchain works

1. Decentralization

One of the primary advantages of Bitcoin’s blockchain is its decentralization. No central authority, like a bank or government, has control over the network. Instead, decisions are made collectively by miners and network participants. This makes the Bitcoin blockchain more resistant to censorship and fraud.

2. Security and Transparency

Bitcoin’s blockchain is highly secure. The Proof of Work (PoW) mechanism ensures that every transaction is validated and added to the blockchain in a secure manner. Once a transaction is recorded, it cannot be altered or erased, which adds a layer of trust and transparency.

Additionally, Bitcoin’s blockchain is public, meaning anyone can view the entire transaction history. This transparency is one of the key factors that make Bitcoin appealing to people who want a financial system that doesn’t rely on trust in central institutions.

3. Immutability

Once data is recorded on the Bitcoin blockchain, it cannot be easily changed or erased. This immutability is a critical feature of blockchain technology. It ensures that the transaction history is reliable and that users cannot alter past transactions to their advantage.

4. Lower Transaction Fees

Bitcoin allows for peer-to-peer transactions, eliminating the need for intermediaries like banks or payment processors. As a result, Bitcoin transactions generally have lower fees than traditional financial systems. This is especially important for international transfers, where Bitcoin can bypass costly fees associated with traditional banking and money transfer services.

5. Accessibility and Inclusion

Bitcoin’s blockchain allows anyone with an internet connection to participate. Whether you’re in a developed country or a remote region, Bitcoin offers an opportunity for financial inclusion, especially for people who don’t have access to traditional banking services.

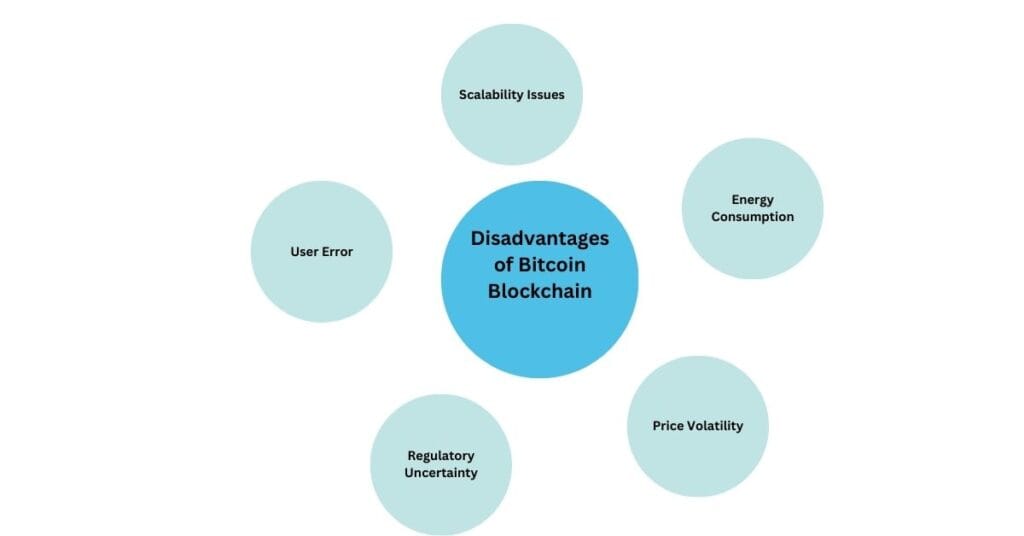

Disadvantages of Bitcoin Blockchain

While Bitcoin’s blockchain offers numerous advantages, there are also some drawbacks to consider.

1. Scalability Issues

One of the main challenges facing Bitcoin’s blockchain is its scalability. The Bitcoin network can only process a limited number of transactions per second. This can lead to delays and higher transaction fees during times of high demand. Solutions like the Lightning Network are being developed to address this issue, but scalability remains a concern.

2. Energy Consumption

Bitcoin mining is an energy-intensive process. The Proof of Work mechanism requires miners to solve complex puzzles, which consumes a significant amount of electricity. Some critics argue that this energy consumption is unsustainable and harmful to the environment, especially as Bitcoin’s popularity grows.

3. Price Volatility

Bitcoin’s price is notoriously volatile. While its value has grown significantly over the years, it can also experience dramatic price swings. This makes Bitcoin a risky asset for people looking for stability and predictability in their investments.

4. Regulatory Uncertainty

Governments around the world are still trying to figure out how to regulate Bitcoin. In some countries, Bitcoin is banned or heavily restricted, while in others, it’s embraced as a legitimate form of payment. This regulatory uncertainty can make it difficult for people to know how to use or invest in Bitcoin, especially in regions with strict laws.

5. User Error

While Bitcoin’s blockchain is secure, individual users can still make mistakes. Losing a private key, sending Bitcoin to the wrong address, or falling victim to scams can result in the loss of funds. This can be a major downside for people who are new to the world of cryptocurrencies.

Bitcoin Blockchain FAQs

Q1: How does Bitcoin’s blockchain differ from traditional banking systems?

A1: Bitcoin’s blockchain is decentralized and doesn’t rely on a central authority like a bank. Transactions are verified by a global network of miners, making it more secure, transparent, and resistant to censorship.

Q2: Can Bitcoin’s blockchain be hacked?

A2: While Bitcoin’s blockchain is highly secure, it is not completely immune to attacks. However, due to its decentralized nature and the Proof of Work mechanism, it is extremely difficult for anyone to manipulate the network.

Q3: What is Bitcoin mining and how does it work?

A3: Bitcoin mining is the process of solving complex mathematical puzzles to validate transactions and add them to the blockchain. Miners use specialized hardware to compete for the right to add a new block and earn Bitcoin rewards.

Summary

Bitcoin’s blockchain technology is a groundbreaking innovation that offers a decentralized, secure, and transparent way of conducting transactions. While there are challenges, such as scalability and energy consumption, the advantages—decentralization, security, and low transaction fees—make it a powerful tool for financial inclusion. As the Bitcoin network continues to evolve, solutions are being developed to address its shortcomings, and its impact on the global financial system continues to grow.

Blockchain Technology: The Future of Secure Data Sharing 2025