The Life of a Bitcoin Miner: Understanding Mining Difficulty and Mining Pools

The Life of a Bitcoin Miner in 2025: Understanding Mining Difficulty and Mining Pools 2025- Mining is one of the core pillars of the Bitcoin blockchain. It is the process through which transactions are validated and added to the blockchain, and miners are the ones who make this possible. But the life of a miner is not as straightforward as it might seem. It involves hard work, competition, technical skills, and sometimes, a little bit of luck.

What is Bitcoin Mining?

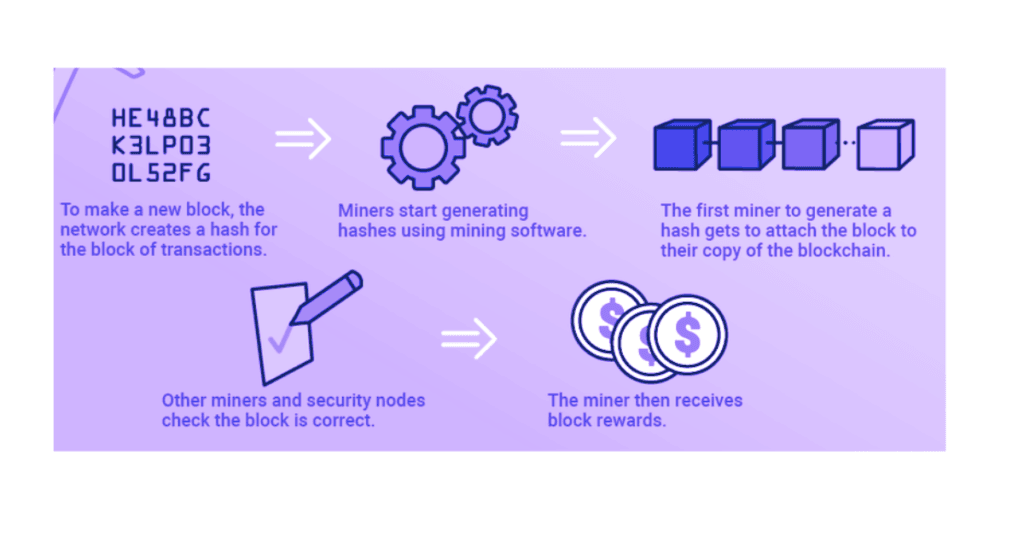

Before diving into the life of a miner, let’s first define Bitcoin mining. Bitcoin mining is the process by which new Bitcoins are created, and transactions are added to the public ledger known as the blockchain. The process involves solving complex cryptographic puzzles, and the first miner to solve a puzzle gets to add a new block to the blockchain and is rewarded with newly minted Bitcoins and transaction fees.

The Life of a Bitcoin Miner

Bitcoin mining may seem like a simple concept, but it is far from easy. Here’s what a typical day in the life of a miner might look like:

Setting Up and Maintaining Equipment

At the heart of a miner’s life is the mining hardware. The most common type of equipment used by Bitcoin miners is the ASIC (Application-Specific Integrated Circuit) miner. These machines are designed specifically for mining Bitcoin and are much more efficient than general-purpose computers.

The miner’s day starts with making sure their equipment is in good working condition. This involves checking for overheating issues, making sure the hardware is properly connected, and ensuring there is no dust accumulation. Some miners even have entire rooms or warehouses dedicated to their mining operations.

Mining and Monitoring the Network

Once the equipment is set up, miners begin their work. They connect their hardware to the Bitcoin network and begin the process of solving cryptographic puzzles. These puzzles are part of the Proof-of-Work consensus mechanism that ensures security and integrity in the Bitcoin blockchain.

While their hardware is working to solve these puzzles, miners must continuously monitor their equipment, ensuring everything runs smoothly. Miners often have dashboards or monitoring software that alerts them in case of any issues. They must also keep track of the network’s performance, as well as the current mining difficulty and Bitcoin price.

Competing for Rewards

Mining Bitcoin is highly competitive. Miners are in a race to solve the cryptographic puzzles, and only the first one to succeed gets the reward. The reward consists of a block subsidy (newly minted Bitcoins) and transaction fees from the transactions included in the block.

However, the chances of winning the race depend on the mining difficulty and the computing power of the miner’s hardware. The more computing power a miner has, the better their chances of solving the puzzle and earning rewards. But the rewards are not always guaranteed, and many miners never actually win a block.

Dealing with Mining Difficulty

As more miners join the Bitcoin network, the mining difficulty increases. Mining difficulty is an important concept in Bitcoin mining, and it plays a huge role in determining the profitability of mining.

What is Mining Difficulty?

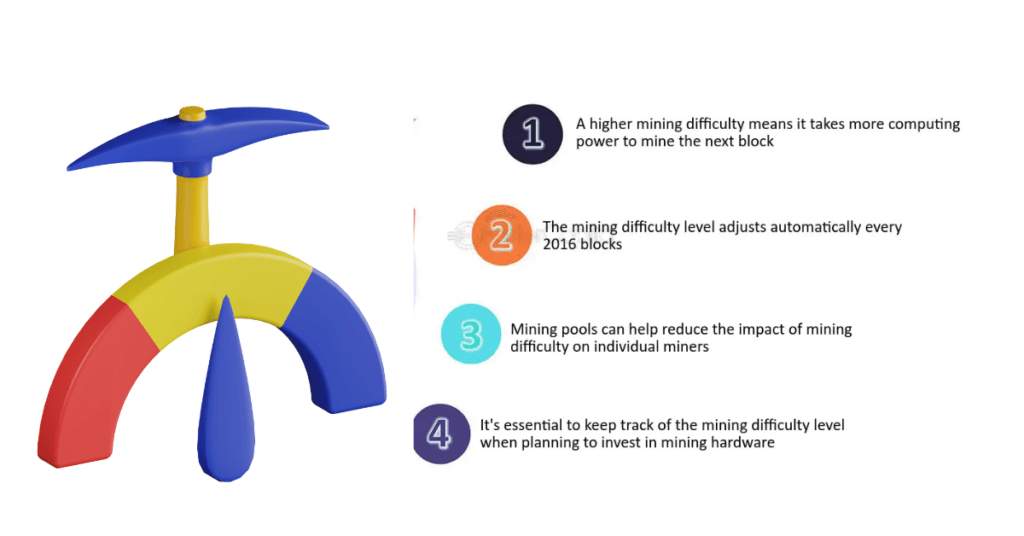

Mining difficulty refers to how difficult it is for miners to solve the cryptographic puzzles required to add a new block to the blockchain. The difficulty is adjusted approximately every two weeks (or every 2016 blocks) based on the total computational power of the network.

The Bitcoin protocol adjusts the difficulty so that, on average, a new block is added to the blockchain approximately every 10 minutes. If more miners join the network and the total computational power increases, the difficulty will increase to maintain the 10-minute block time. Conversely, if miners leave the network, the difficulty will decrease to make it easier to mine blocks.

How Mining Difficulty Affects Miners

Mining difficulty has a significant impact on a miner’s operations. Higher difficulty means that miners must invest in more powerful hardware and pay more in electricity costs to remain competitive. This makes mining less profitable for those with less powerful equipment.

When difficulty increases, it becomes harder to find blocks and earn rewards. This means that miners need to continuously upgrade their hardware and optimize their operations to remain profitable. For individual miners or small-scale mining operations, it can be difficult to compete against larger mining farms with more resources.

Mining Pools: Working Together to Mine Bitcoin

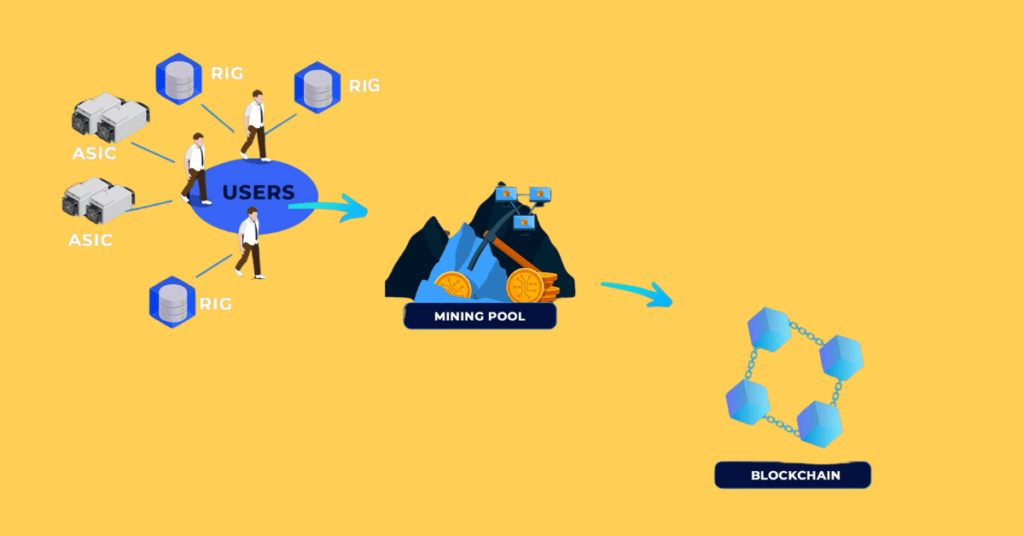

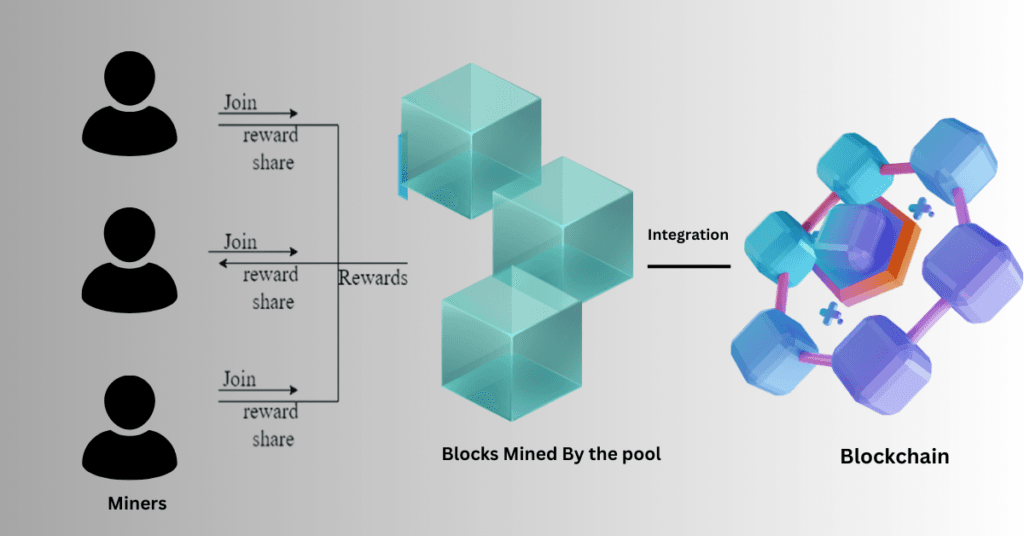

Due to the increasing mining difficulty and high competition, many miners have turned to mining pools as a way to increase their chances of earning rewards. A mining pool is a group of miners who combine their computational power to mine Bitcoin more effectively. The rewards are then distributed among the pool members according to the amount of computational power they contributed.

What is a Mining Pool?

A mining pool is essentially a collective effort where many miners share their processing power to solve the cryptographic puzzles required to mine Bitcoin. Instead of each miner working alone and competing for rewards, they pool their resources and share the rewards more evenly.

Mining pools have become a crucial part of the Bitcoin ecosystem. Without pools, many small-scale miners would find it nearly impossible to compete with large mining operations. By joining a mining pool, miners can ensure a more consistent stream of rewards, even if they are not the ones to solve the cryptographic puzzle first.

How Do Mining Pools Work?

When a group of miners joins a mining pool, they contribute their computing power to the pool’s total hash rate. The pool uses this combined power to work on solving the cryptographic puzzles. Once a puzzle is solved, the pool earns the reward (block subsidy and transaction fees), and it is distributed to the miners based on their contribution.

For example, if a miner contributes 10% of the pool’s total hash rate, they will receive 10% of the reward when the pool successfully mines a block.

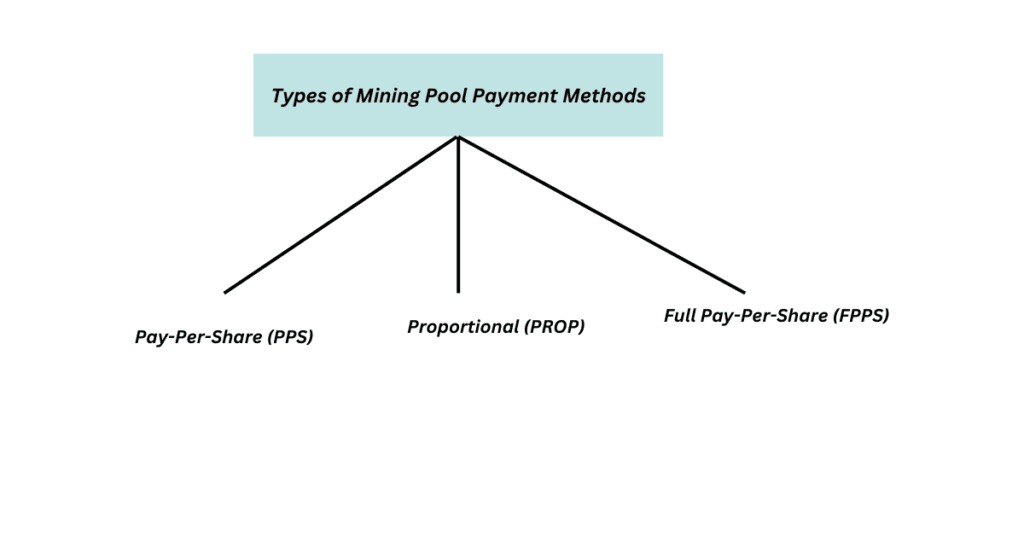

Types of Mining Pool Payment Methods

Different mining pools offer various ways to distribute rewards among their members. Some common methods include:

- Pay-Per-Share (PPS): Miners are paid a fixed rate for each share they contribute, regardless of whether the pool successfully mines a block.

- Proportional (PROP): Miners are paid based on the proportion of work they contribute to the pool. The more shares they submit, the larger their reward when the pool mines a block.

- Full Pay-Per-Share (FPPS): This is similar to PPS, but it includes transaction fees in the payout. Miners receive a fixed payment per share, plus a portion of the transaction fees.

Each pool has its own rules and payout methods, so miners need to carefully choose which pool they want to join based on their preferences and goals.

Advantages and Disadvantages of Mining Pools

Advantages:

- More Consistent Rewards: Mining pools provide a more predictable and stable source of income compared to solo mining.

- Lower Risk: By pooling resources, miners reduce the risk of never finding a block and missing out on rewards.

- Less Hardware and Electricity Investment: Pooling resources means individual miners do not have to spend as much on powerful hardware and electricity to remain competitive.

Disadvantages:

- Fees: Most mining pools charge a fee (usually between 1-3%) for their services.

- Centralization: Mining pools can lead to centralization, as large pools control a significant portion of the network’s total hash rate.

- Less Control: Miners in a pool have less control over the mining process and may not be able to make decisions about the pool’s operations.

The Life of a Bitcoin Miner in 2025 – FAQs

Q1: What is the role of mining difficulty in Bitcoin mining?

A1: Mining difficulty determines how hard it is for miners to solve the cryptographic puzzles and add a new block to the blockchain. It is adjusted every two weeks to ensure that a new block is added every 10 minutes on average.

Q2: Why do miners join mining pools?

A2: Miners join mining pools to combine their computational power with others, increasing their chances of earning rewards. By pooling resources, miners can earn more consistent payouts.

Q3: How are rewards distributed in a mining pool?

A3: Rewards in a mining pool are distributed based on the amount of computational power each miner contributes. Common payout methods include Pay-Per-Share (PPS) and Proportional (PROP).

Summary

Bitcoin mining is a complex and competitive process. Miners work tirelessly to solve cryptographic puzzles, competing for rewards. However, with increasing mining difficulty and the need for significant computational power, many miners are turning to mining pools to increase their chances of success. While mining pools offer more consistent rewards, they also come with their own set of challenges, such as fees and centralization.