Understanding Cryptocurrency in Blockchain 2025

Understanding Cryptocurrency in Blockchain 2025 – In today’s digital world, cryptocurrencies are changing the way we think about money, transactions, and even the very idea of value. The backbone of cryptocurrencies like Bitcoin, Ethereum, and others is blockchain technology, a system that ensures these digital currencies are secure, transparent, and decentralized.

What is Cryptocurrency?

Cryptocurrency is a type of digital or virtual currency that uses cryptography for security. Unlike traditional currencies, cryptocurrencies don’t rely on central banks or governments to issue them. Instead, they are created, managed, and stored on a decentralized network, making them independent of any central authority.

Bitcoin, Ethereum, and Ripple are some of the most popular cryptocurrencies today. But there are thousands of cryptocurrencies, each with its unique features, use cases, and technologies.

The Role of Blockchain in Cryptocurrency

To understand cryptocurrency fully, we need to talk about blockchain technology. Blockchain is a decentralized, digital ledger that records all transactions across a network of computers. Each transaction is grouped into a “block” and added to a chain of previous transactions (hence the term “blockchain”). Once a block is added, it becomes part of an immutable record that cannot be altered or deleted, making blockchain technology both secure and transparent.

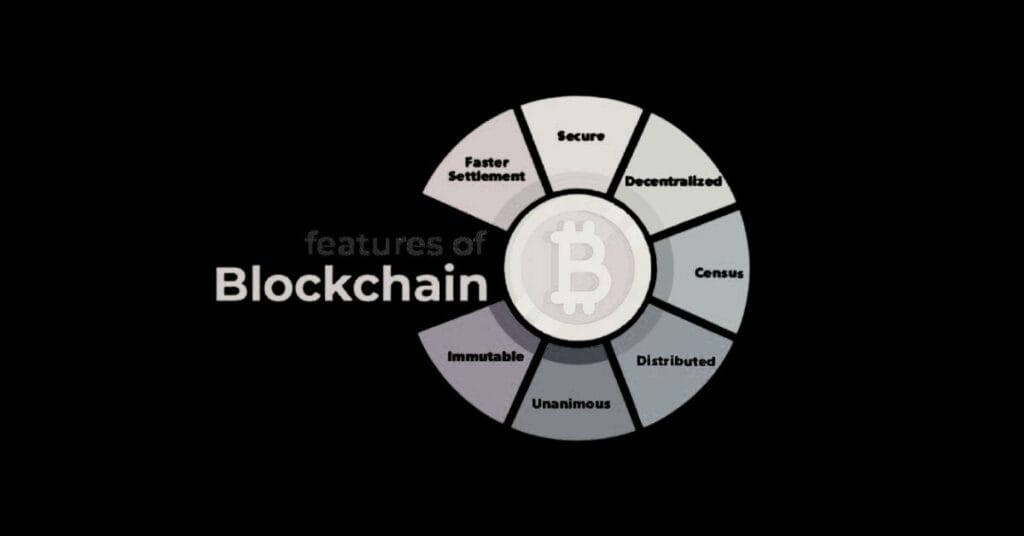

Key Principles of Blockchain in Cryptocurrency

- Decentralization – No central authority controls the blockchain; it is maintained by a global network of computers (nodes).

- Transparency – All transactions are recorded on a public ledger, visible to anyone.

- Immutability – Once recorded, transactions cannot be altered or deleted.

- Security – Cryptographic algorithms ensure secure transaction verification.

1. Decentralization – No Single Authority

What It Means

Unlike traditional banks that control money, blockchain is run by a network of computers (nodes) worldwide. No single company, bank, or government owns it.

Why It Matters

- No central authority can freeze or block transactions.

- Users have full control over their funds.

- It reduces the risk of system failures or hacking since there is no single point of attack.

2. Transparency – Everything is Visible

What It Means

Every transaction is recorded on a public ledger, which anyone can view.

Why It Matters

- No hidden fees or secret changes—everything is open and verifiable.

- Prevents fraud because anyone can check past transactions.

- Builds trust among users since records cannot be altered.

3. Security – Safe and Tamper-Proof

What It Means

Blockchain uses cryptographic hashing (a form of digital fingerprinting) to make transactions secure and unchangeable.

Why It Matters

- Transactions cannot be changed once recorded, preventing fraud.

- Data is stored across multiple computers, making it almost impossible to hack.

- Uses strong encryption to keep user information private.

4. Immutability – No One Can Change the Past

What It Means

Once a transaction is added to the blockchain, it cannot be deleted or modified.

Why It Matters

- Prevents fraud and tampering.

- Creates a trustworthy financial system without banks.

- Ensures a permanent, unaltered record of transactions.

5. Fast and Low-Cost Transactions

What It Means

Cryptocurrency transactions are much faster and cheaper than traditional banking.

Why It Matters

- No need for banks to process payments.

- Cross-border payments can be done in minutes instead of days.

- Lower transaction fees compared to credit cards or banks.

6. Peer-to-Peer Transactions – No Middlemen

What It Means

Blockchain allows people to send money directly to each other, without needing a bank or service like PayPal.

Why It Matters

- Saves money on transaction fees.

- No bank approvals needed—anyone can send money anytime.

- No restrictions, even for people without bank accounts.

7. Smart Contracts – Automating Transactions

What It Means

Smart contracts are self-executing agreements that run automatically when certain conditions are met.

Why It Matters

- No need for lawyers or paperwork.

- Ensures fair and automatic execution of agreements.

- Used for buying property, insurance claims, and business deals.

8. Anonymity – Privacy for Users

What It Means

Unlike banks, blockchain does not require personal information to make transactions. Users are identified by their wallet addresses, not names.

Why It Matters

- Protects user identity and financial data.

- Reduces risks of identity theft or fraud.

- Provides financial privacy while still being secure.

9. Global Accessibility – Open to Everyone

What It Means

Anyone with an internet connection can use blockchain and cryptocurrency.

Why It Matters

- No restrictions—even people without bank accounts can use it.

- Allows for fast global payments.

- Gives financial freedom to people in countries with unstable banking systems.

10. Trust and Reliability – The System Runs Itself

What It Means

Blockchain operates on a trustless system, meaning you don’t have to trust a bank or third party—only the technology.

Why It Matters

- No need to trust a middleman, only the blockchain itself.

- Always works—the system does not depend on human decisions.

- Increases confidence in digital payments and investments.

Simple Diagram of How Blockchain Works

+--------------------------------------------------+

| Block (Transaction Data) |

|--------------------------------------------------|

| - Previous Block Hash |

| - List of Transactions |

| - Timestamp |

| - Nonce (Proof of Work) |

+--------------------------------------------------+

↓ Linked to Next Block ↓

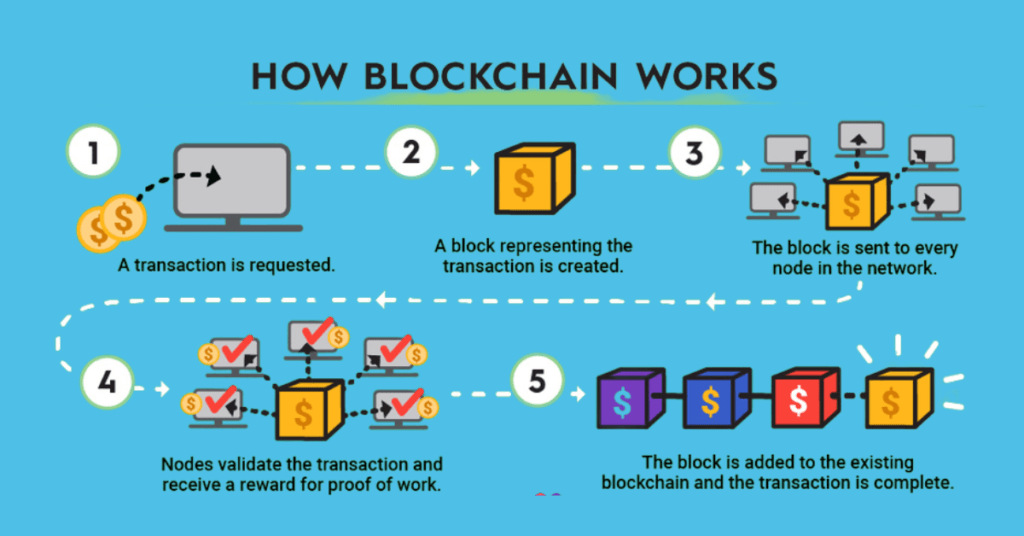

Step-by-Step Process of How Blockchain Works in Cryptocurrency

1. Transaction Initiation

- A user wants to send cryptocurrency (e.g., Bitcoin) to another user.

- The transaction contains details like sender address, receiver address, and the amount.

- The transaction is broadcasted to the blockchain network.

2. Transaction Verification

- Nodes (computers) in the network validate the transaction.

- They check whether the sender has enough balance and confirm transaction legitimacy.

- If valid, the transaction is added to a pool of pending transactions.

3. Block Formation

- Verified transactions are grouped into a block by miners (or validators in some blockchains).

- Each block includes:

- Previous block hash (to link it to the blockchain).

- Merkle root (a cryptographic summary of all transactions in the block).

- Nonce (a random number used in Proof of Work).

- Timestamp (when the block was created).

4. Consensus Mechanism (Mining or Validation)

- The network must agree on the validity of transactions before adding a block.

- Two main methods ensure consensus:

- Proof of Work (PoW) – Used in Bitcoin, where miners solve complex mathematical puzzles to validate transactions.

- Proof of Stake (PoS) – Used in Ethereum 2.0, where validators stake cryptocurrency to confirm transactions.

5. Block Addition to Blockchain

- Once validated, the new block is added to the existing blockchain.

- Each block is linked to the previous one, creating an immutable chain.

- Transactions within the block are now permanently recorded.

6. Transaction Completion

- The receiver gets the cryptocurrency in their wallet.

- The transaction is confirmed by multiple blocks, ensuring security.

- The process is irreversible, meaning no one can alter the transaction.

Why Blockchain is Important for Cryptocurrency

- Removes Intermediaries – No need for banks or third parties.

- Fast Transactions – Cross-border payments without delays.

- Lower Costs – No high banking fees.

- Censorship Resistance – No government or entity can block transactions.

Blockchain technology revolutionized digital finance, enabling secure, decentralized, and transparent transactions. It is the backbone of cryptocurrencies, ensuring trust and security in a trustless system.

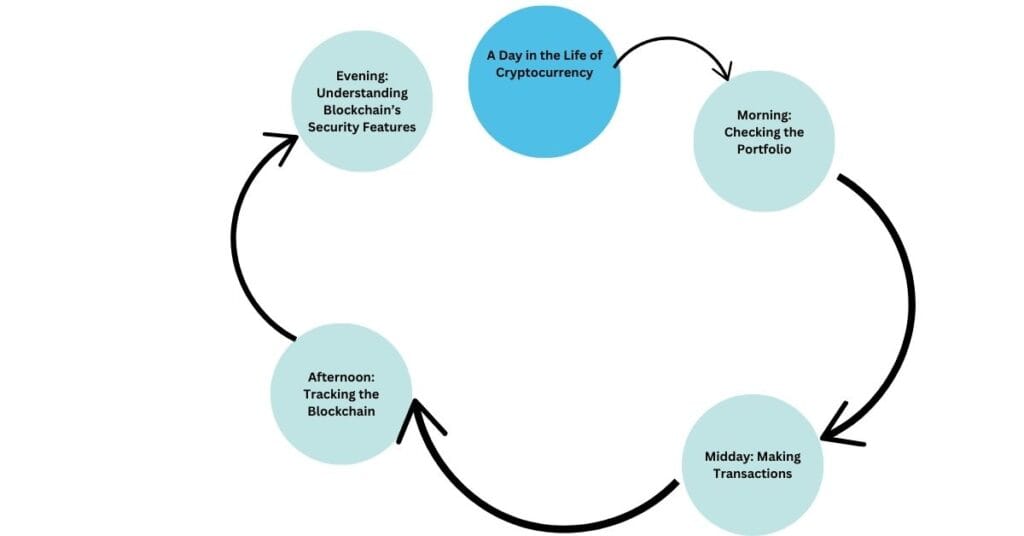

A Day in the Life of Cryptocurrency

Let’s explore what a day in the life of someone using cryptocurrency might look like:

Morning: Checking the Portfolio

Just like checking a traditional bank account, cryptocurrency holders start their day by checking their portfolios. Many people use crypto wallets (digital apps or devices) to store their cryptocurrency securely. These wallets allow users to send, receive, and track their coins.

For example, let’s say Sarah owns 2 Bitcoins. She logs into her wallet app and checks the current value of Bitcoin. Depending on market conditions, the price could fluctuate throughout the day, sometimes drastically. Sarah can either hold her Bitcoins, send them to someone else, or sell them for traditional currency if she needs to.

Midday: Making Transactions

During the day, Sarah might use her Bitcoin to make a purchase. For example, she could buy lunch at a cafe that accepts cryptocurrency. The payment process is relatively simple:

- Sarah opens her crypto wallet app.

- She selects the amount of Bitcoin she wants to send to the cafe’s wallet address (each wallet has a unique address, similar to a bank account number).

- The app generates a transaction request, which is then verified and recorded on the blockchain.

Once the transaction is complete, the cafe can see that Sarah has made a payment, and the transaction is recorded on the blockchain. Since blockchain is transparent, anyone can verify that Sarah’s payment was legitimate.

Afternoon: Tracking the Blockchain

As Sarah goes about her day, she knows that every Bitcoin transaction is being monitored and validated by miners on the blockchain. These miners are individuals or groups of people who use computing power to solve complex cryptographic puzzles. This process is called mining, and miners are rewarded with cryptocurrency (often the same cryptocurrency they are mining) for successfully validating and adding transactions to the blockchain.

Sarah may not be directly involved in mining, but she benefits from it every time she makes or receives a transaction. The decentralized nature of blockchain ensures that all participants agree on the transaction history, preventing fraud or double-spending.

Evening: Understanding Blockchain’s Security Features

Before going to bed, Sarah reviews the security measures involved in using cryptocurrency. Each time she makes a transaction, it’s signed with her private key, a secure digital signature that proves ownership of her cryptocurrency. Her private key is never shared with anyone—only her public key (akin to an account number) is used to receive funds.

Moreover, all Bitcoin transactions are recorded on the blockchain, meaning once a transaction is made, it cannot be altered. This immutability is one of the strongest aspects of blockchain, as it ensures that once funds are sent, they are gone for good.

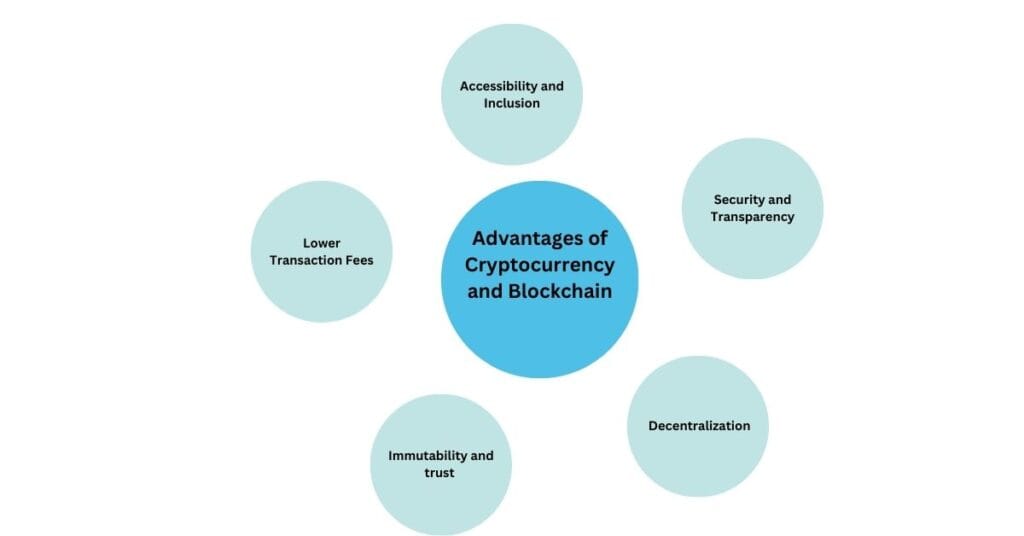

Advantages of Cryptocurrency and Blockchain

Now that we have a basic understanding of how cryptocurrency and blockchain work, let’s look at some of the key advantages:

1. Decentralization

One of the main benefits of cryptocurrency is that it’s decentralized. Unlike traditional currencies that rely on banks or governments, cryptocurrencies are governed by the people using them. This means there’s no single entity that controls the network, which can reduce the risk of manipulation or corruption.

2. Security and Transparency

Blockchain technology is designed to be secure and transparent. Once a transaction is recorded on the blockchain, it’s nearly impossible to alter. This makes it difficult for anyone to tamper with the system. Additionally, anyone can access the blockchain and view transaction history, ensuring full transparency.

3. Lower Transaction Fees

When you send money through a bank or a payment provider, there are usually fees involved. With cryptocurrency, these fees are often much lower (or even nonexistent), especially for international transfers. This can make cryptocurrency a cost-effective alternative to traditional payment systems.

4. Global Accessibility

Cryptocurrency is accessible to anyone with an internet connection. This means that people in developing countries or regions with limited access to traditional banking services can still participate in the global economy. All they need is a smartphone or computer to send, receive, and store cryptocurrencies.

5. Immutability and Trust

The immutability of blockchain ensures that once a transaction is recorded, it cannot be changed. This builds trust in the system, as users don’t have to worry about fraudulent activity or changes to the transaction history.

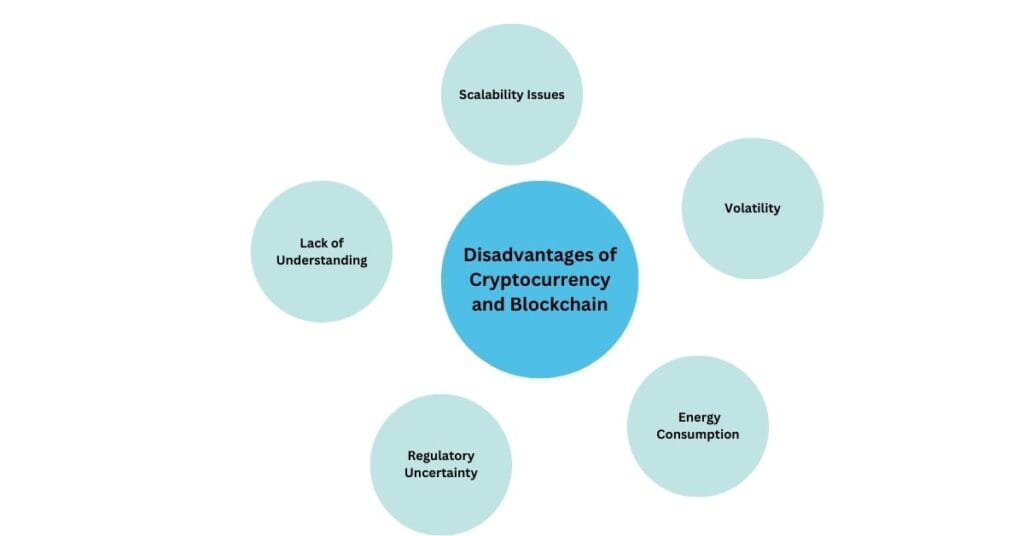

Disadvantages of Cryptocurrency and Blockchain

While cryptocurrency offers many advantages, there are also some drawbacks to consider:

1. Volatility

Cryptocurrency prices can be highly volatile. Bitcoin and other cryptocurrencies have seen massive price fluctuations over short periods, which can make them risky investments. For people who are looking for stable assets, the volatility of cryptocurrencies may be a turn-off.

2. Scalability Issues

Bitcoin and other cryptocurrencies can face scalability issues. The number of transactions that can be processed on the blockchain is limited, which can cause delays and higher transaction fees during times of high demand. Solutions like the Lightning Network are being developed to address this problem, but it remains a challenge.

3. Energy Consumption

Mining, especially for cryptocurrencies like Bitcoin, requires a lot of energy. The computational power needed to validate transactions and secure the blockchain network can consume enormous amounts of electricity. This has raised environmental concerns about the sustainability of crypto mining in the long run.

4. Regulatory Uncertainty

The regulatory landscape for cryptocurrency is still uncertain. Governments and financial institutions are figuring out how to treat cryptocurrencies. Some countries have embraced them, while others have imposed bans or strict regulations. This regulatory uncertainty can create a risky environment for investors and users.

5. Lack of Understanding

Despite their growing popularity, many people still don’t fully understand how cryptocurrencies and blockchain work. This lack of knowledge can lead to mistakes, such as losing private keys, falling for scams, or making incorrect transactions. Education is key to ensuring safe and effective use of cryptocurrencies.

FAQs

Q1: How do I buy cryptocurrency?

A1: You can buy cryptocurrency through exchanges like Coinbase, Binance, or Kraken. You’ll need to create an account, deposit traditional currency (like USD), and then use that to buy cryptocurrency.

Q2: What’s the difference between Bitcoin and Ethereum?

A2: Bitcoin is primarily a store of value and a medium of exchange, while Ethereum offers a platform for decentralized applications (DApps) and smart contracts. Ethereum also has its own cryptocurrency, Ether.

Q3: How secure is cryptocurrency?

A3: Cryptocurrency transactions are secured using cryptography and recorded on the blockchain, which is highly secure. However, the security of your cryptocurrency also depends on how well you protect your private key.

Summary

Cryptocurrency and blockchain technology are transforming the way we think about money, transactions, and trust. With their decentralization, security, and transparency, cryptocurrencies offer a wide range of benefits, from lower fees to global accessibility. However, issues like volatility, energy consumption, and regulatory uncertainty need to be addressed for widespread adoption.